Macroeconomic Overview

The growth rate of the world economy and Russia’s economy has a significant impact on the country’s electricity sector and the results of activities at Unipro PJSC.

In 2018, the global economy faced serious challenges: trade wars, collapses in the stock market, currency and digital markets, as well as record-breaking spikes in oil price. Despite the truce announced in December 2018, the China–United States trade war had a negative impact on the level of global demand. De-dollarisation was also one of the main topics which have emerged over the past year — against a backdrop of the global economy’s dependence on the US dollar, many countries are considering the prospect of abandoning dollar transactions and switching to settlements in their national currency.

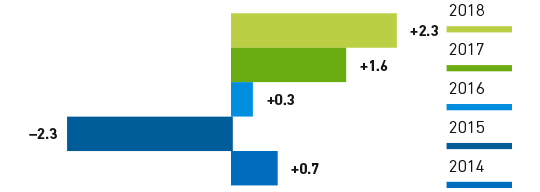

According to the International Monetary Fund (IMF)*, global growth in 2018 was 3.7% (3.8% in 2017), despite lower rates (relative to forecast) in some countries in Europe and Asia. The IMF reports a slowdown in the rates of world economic growth, increasing risks and a current state of uncertainty. According to the IMF forecast, the growth of the world economy will be 3.5% in 2019 and 3.6% in 2020.

The dynamics of electric power consumption is one of the key elements affecting the energy market, especially under conditions of surplus of generating capacity created after the generators had achieved their objectives within the programmes for commissioning new power units under capacity supply agreements (CSA)

According to estimates from the Ministry of Economic Development of Russia*, Russia's economy continued the growth trend that started in 2017 after the 2015–2016 recession. GDP growth was 2.3%. Inflation was 4.3% after 2017 saw the lowest rate in Russia’s entire modern history at 2.5%.

The increase in GDP received a positive influence from the positive situation in the commodity markets. The prices of key Russian exports (oil, gas, ferrous and non-ferrous metals, rolled steel, coal) in 2018 were higher than in 2017.

was the global economy growth in 2018

The dynamics of oil prices was especially steep in the reference period. The price for the Brent Crude Oil grew for almost the entire year in 2018, reaching $85 per barrel in October. After the October peak, the prices fell into a downward spiral, which lasted until the end of December. Brent Crude Oil ended 2018 at $53.8 per barrel.

In December 2018 amid falling of oil prices, OPEC+ countries agreed to reduce oil production. The OPEC+ agreement should balance the demand and supply of oil in 2019, but this balance will depend on geopolitics. Experts are not ruling out other new shocks in this sensitive market.

Balancing of the oil market in the electric power industry affects electric power consumption and its regional distribution. In the forecast for the development of the oil industry, the Ministry of Economic Development of Russia suggests stabilisation and a gradual decline in production in Western Siberia and an increase in Eastern Siberia.

According to SO UES JSC*, power consumption in 2018 increased by 1.5% compared to last year. This value is higher than predicted in the Scheme and Programme of Development of the Unified Energy System of Russia, developed by the Russia’s Ministry of Energy.

The Tyumen Region (Western Siberia) stands out among the regions Unipro PJSC plants are located, where consumption decreased by 2% compared to 2017, which is connected with the implementation of the OPEC+ agreement to reduce oil production.